The correlation is -0.31913841654250047 and the p-value is 0.0508

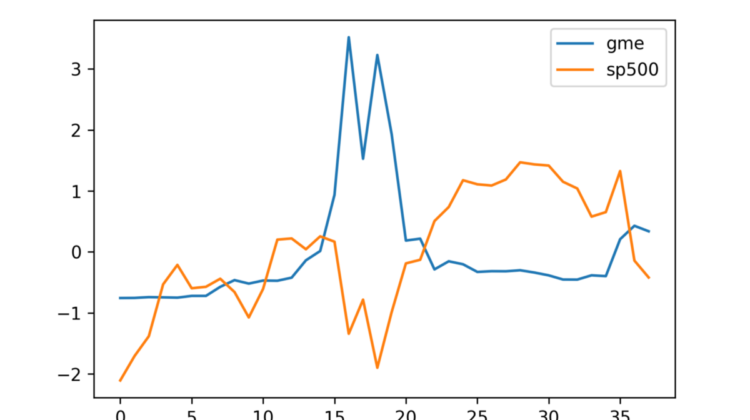

We can see that there is significant statistical evidence (borderline significance) that when GME goes up, SP500 goes down.

In other words, there is a negative correlation of -0.32 between the GME and S&P500 price.

One logical explanation could be that the hedge funds unload other assets to cover their short position in GME. So, when GME skyrockets, we see a mass selloff. That’s the conspiratorial angle but could be proven valid.

Let’s see!

That’s all folks ! Hope you liked this short article!