Clairvoyant leverages AI and ML in many of its projects to deliver efficient solutions to its clients. Tapping into Clairvoyant’s experience managing projects involving the two technologies, this blog aims to take you through the role of AI and ML in faster payments with decreased fraud.

Introduction:

In recent years digital transformation has scaled across industries, but the financial sector, in particular, has undergone a tremendous transformation. This transformation is due to the rise of Artificial Intelligence (AI) and Machine learning (ML).

AI has the ability to replicate human behaviors like learning and cognition. From natural voice recognition to online shopping recommendations, AI is shaping the world to our convenience. Through machine learning algorithms, payments can analyze more data in new and innovative ways to identify fraudulent activity.

Each consumer transaction produces a lot of data and with the help of AI and ML, companies that use payments can search rapidly and efficiently through this data beyond the standard set of factors such as time, velocity, and amount.

Why AI & ML?

- Better performance during payments

- Reducing/Identifying fraudulent transactions

Payments industries eternally struggle to protect and secure the system from financial harm such as theft, fraudulent charges caused by criminals, etc.

According to Research by Juniper, in the coming years, there will be more investments in advanced fraud detection and prevention technologies by Payment industries. No other industry’s payment companies are committed to fighting against fraud.

Payment industries are aggressive in fighting against fraud to reduce losses since consumers are never liable if they are made the victim of fraud through their electronic payments.

According to Visa, post the rollout of “chip card”(EMV cards), deceptive card fraud at brick-and-mortar retailers have faced a 76 percent decrease. The overall volume of card fraud on card-based payments worldwide also declined in 2018 over 2015.

As retail moves toward e-commerce, payments have become easier for customers and it has simultaneously become simpler for criminals to commit fraud because the physical card is not necessarily present during the transaction which makes fighting fraud more complex. The trend among victimizers is clear because of the absence of the card, fraud grew by 41 percent year-over-year between 2015 and 2018, raising from 27 percent of cases in 2015 to 76 percent in 2018. By comparison, card-present fraud constituted only 19 percent of cases in 2018, down from 70 percent in 2015.

In a rule-based approach, fraud analysts write the algorithms based on strict rules. If any changes are detected for a new fraud then they have to be done either by creating new algorithms or by making those changes manually.

In this approach, the human effort also increases with the rising number of customers and data.

So, the rule-based approach is time-consuming and costly. Another flaw in this approach is likely to have false positives. The outcome of a particular transaction depends on the guidelines and rules made for training the algorithm for non-fraudulent transactions. The major issue with the false-positive conditions is the loss of genuine customers.

Let’s understand how a Machine Learning system works for Fraud Detection!

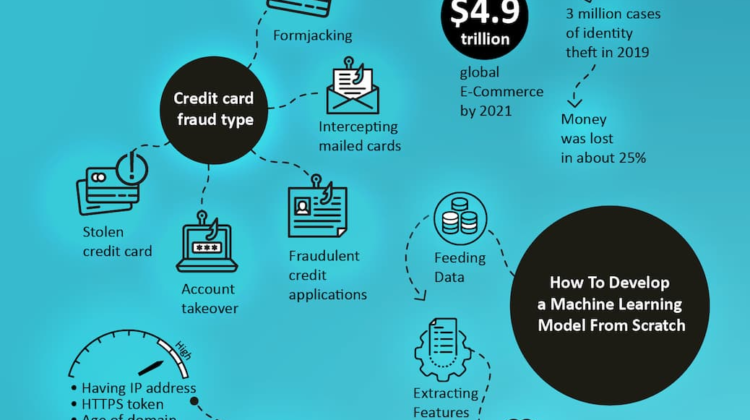

The below picture illustrates the basic structure.

How do fraud detection algorithms work with the help of Machine Learning?

Feeding Data: Firstly we need to feed data into the model. The accuracy varies based on the amount of data we train the model with — the more data the better the model performs.

We need to input more and more amounts of data into the model to facilitate the detection of frauds specific to a particular business. Feeding data will train your model in a way that detects fraudulent activities specific to your business.

Extracting Features: This works on fetching the information of each record associated with a transaction process. With these, we can identify the customer location from where the transaction is made, and what mode of payments are used for transactions.

- Identity: This helps to validate customer mobile numbers, email addresses, etc. We can use it to check the credit score information when a customer requests a loan.

- Location: The algorithm checks the customer IP address with the help of location and the rate of fraud associated with that IP and shipping address.

- Mode of Payment: It checks the different cards used for the transaction, cards from different countries, the assessment of fraud of the bank account used, and the name of the cardholder.

- Network: It inspects the mobile numbers and email accounts used in each transaction in a network.

Training Algorithm: Once the fraud detection algorithm is created, you need to train it by providing customer data. This allows it to learn how to

differentiate between ‘fraudulent’ and ‘genuine’ transactions.

Creating a Model: The model is fit to differentiate between ‘fraudulent’ and ‘genuine’ transactions in business once the algorithm is trained with a proper dataset.

In Machine Learning, there are many different options used for fraud detection. By going through a few use cases, we will understand how Machine Learning is used in fraud detection.

Fraud Detection Machine Learning Algorithms Using Logistic Regression: Logistic Regression is a statistical model that in its basic form uses a logistic function technique when the decision is based on categories like fraud and non-fraud.

- Environment: Python 3 and Jupyter Notebook

- Library: Pandas

- Module: Scikit-learn

Considering the Dataset

Let us inspect the dataset before we get started with the hands-on. Here is a Heart Disease sample data, with approximately 303 rows and 13 attributes with a target column.

In this example, we will build a classifier to predict if a patient has heart disease or not.

Building a Model

Now that the sample data is well known, we need to set up a logistic regression model using the Python scikit learn library.

Step 1: Load the data using the Pandas library

Step 2: Have a brief look at the shape

Step 3: See how the dataset looks

Step 4: Variables

Step 5: Now the data is split into dependent and independent variables

Step 6: Test sets using scikit learn

Step 7: Train the algorithm using scikit

Step 8: In this step, the test set results are predicted

Step 9: Step to Measure the accuracy

Step 10: Confusion matrix module from scikit

- Positive classes envisioned correctly as a positive class is 20.

- Negative classes envisioned incorrectly as a positive class is 6.

- Positive classes envisioned incorrectly as a negative class is 10.

- Negative classes envisioned correctly as the negative class is 25.

Conclusion:

AI & ML provide a very good opportunity for smart mobile/digital payments as customers can pay quickly, easily, and at a low cost. Privacy is a major concern for most consumers. With the knowledge and technology available today, we see more products focused on a specific group of customers. This idea or concept is not new, however, it is very promising when targeting and addressing the right issues that customers are facing. By using AI and ML, we can stop/reduce all frauds.

We should start using AI and ML which can bring behavioral bio-metrics to narrow the gap and remove the vulnerability of payment systems, especially in online payments.

For more information or further queries, please email us at sales@clairvoyantsoft.com or call us at (623)282–2385. Learn more at http://clairvoyantsoft.com.